As of 1 April 2022, the temporary insolvency restrictions under the Corporate Insolvency and Governance Act 2020 (CIGA) expired. This is of course good news for creditors, (who can revert back to issuing Statutory Demands and commencing Winding Up proceedings for any sums owing over £750), but bad news perhaps for those companies that still find themselves struggling financially and unable to pay outstanding debts that accumulated during the pandemic.

So what were the temporary restrictions, and what does it mean now that they have been lifted?

You will recall that, back at the beginning of the pandemic, the Government introduced what was probably the quickest ever piece of law to pass through Parliament – The Corporate Insolvency and Governance Act 2020 (CIGA). CIGA was introduced to support businesses, help them to avoid insolvency and survive as a going concern, and included measures such as a ban on statutory demands and restrictions as to when Winding Up petitions could be presented.

Whilst only meant to remain in place for a short time, the measures were repeatedly extended as the effects of the pandemic continued, however they were (kind of) brought to an end on 1st October 2021, when the Government announced that the temporary measures introduced by CIGA were to be ‘phased out’.

Statutory Demands were officially back up and running, as were Winding Up petitions, albeit with a few ongoing conditions in place. For example, the minimum debt for which a Winding Up petition could be presented was £10,000! (quite the increase from £750). In addition, Creditors were required to serve a Schedule 10 Notice on a debtor providing it with 21 days to make payment or to provide reasonable settlement proposals before issuing a winding up petition.

As of 1st April, these restrictions are no more – meaning that we revert back to how things were pre-pandemic or (dare I say it) ‘back to normal’. This means:

- Statutory Demands can be served, giving 21 days for payment. Failure stands as evidence of inability to pay and Winding Up proceedings can be subsequently commenced.

- The minimum sum for which a petition can be issued reverts back to £750.

- There is no additional requirement to give debtors the option to make repayment proposals as previously required by a Schedule 10 Notice.

N.B. it is important to note there remain temporary restrictions on issuing winding up petitions (and bankruptcy petitions) for arrears of ‘protected rent debts’ incurred during the COVID pandemic. This includes action against tenants, former tenants and guarantors.

Good News? Bad News?

For creditors who have held off taking debt recovery action over the past 2 years, now may be the time to change that. Perhaps a creditor has had a debt due and owing in the sum of £7,500 but, due to the increased minimum sum, have been unable to proceed with a Winding Up petition. Such action is now possible.

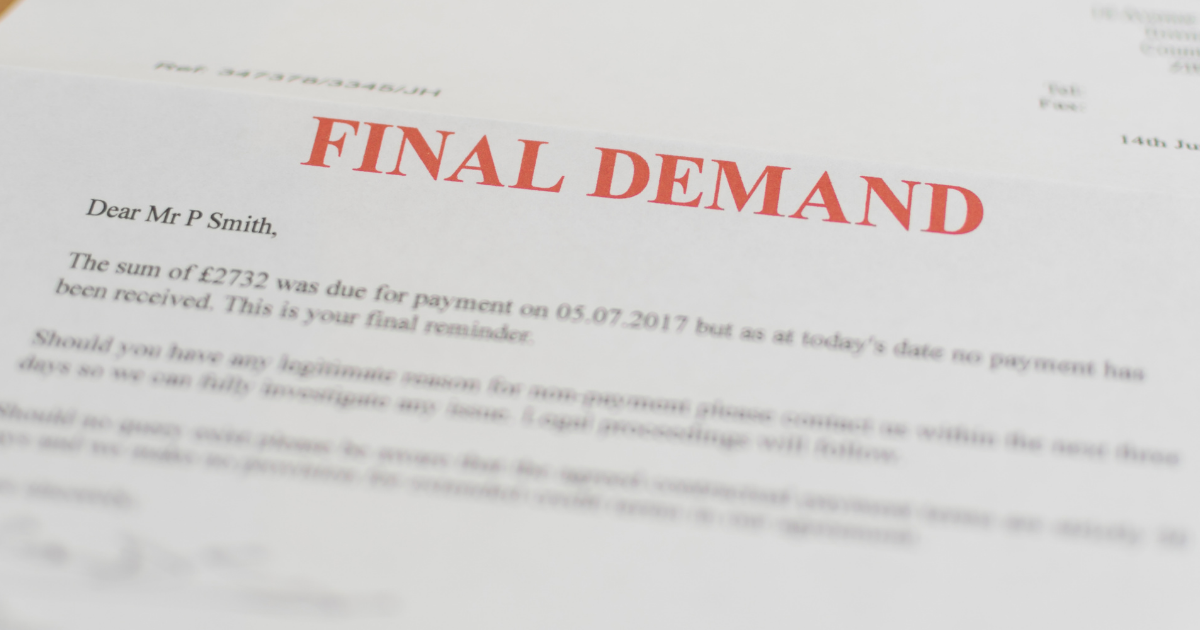

On the other hand, for many months, debtors and those businesses struggling financially, knew that if they received a statutory demand in the post – it was meaningless and so could simply be ignored. That position is definitely no more, and failure to address such a demand could have extreme consequences.

If you are considering taking action to recover an outstanding debt or, to the contrary, are on the receiving end of payment demands from your creditors and require assistance – please do not hesitate to contact

Krystene@travlaw.co.uk

or

0113 258 0033

This article was originally published on: 7 April 2022